The Role of Predictive AI in Finance Transformation

Share Blog

With the explosion of data, rapid digital transformation, and shifting customer expectations, the finance sector is facing disruption at an unprecedented scale. Financial institutions now grapple with a critical question:

How can we survive and succeed in this fast-paced environment?

The answer increasingly lies in Predictive AI. Once optional, it has become the anchor for financial institutions navigating turbulent waters — helping them anticipate risks, personalize services, and drive efficiency like never before.

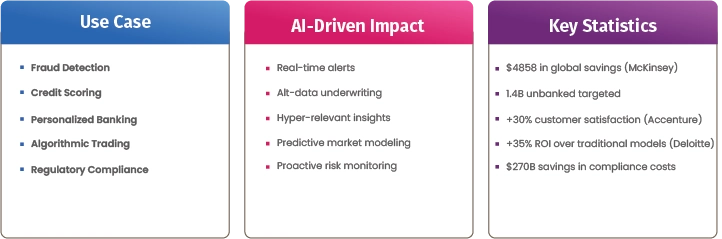

A Snapshot: What Predictive AI Can Achieve for Finance Sector

The Beginning: What Is Predicitve AI

Predictive AI uses machine learning, algorithms, and statistical models to analyze current and historical data, uncover patterns, and predict future outcomes. It helps financial institutions:- Estimate customer behavior (e.g., churn risk)

- Forecast market movements

- Detect fraud before it happens

- Optimize business decisions proactively

The Action Mode: How Predictive AI Actually Helps Finance Sector

1. Tackling the Data Deluge- The global financial system generates 2.5 quintillion bytes of data daily — from stock trades and economic signals to customer interactions and social sentiment.

- By 2025, finance will account for 10% of the world’s structured data (IDC).

- Global fraud losses reached $485B in 2023 (McKinsey).

- Cybercrime could cost $10.5T annually by 2025 (Cybersecurity Ventures).

- Predictive AI models detect anomalies in:

- Transaction speed & geolocation

- Suspicious behavior sequences

- Device access patterns

- Behavioral biometrics (typing/mouse activity)

- Case in Point: Mastercard analyzes 75B+ transactions annually with AI, achieving 99% fraud detection accuracy while reducing false positives.

- 1.4B people remain unbanked worldwide (World Bank).

- Traditional credit scoring overlooks many due to lack of formal history.

- Predictive AI expands credit access using alternative data:

- Rent & utility payments

- Mobile usage & bills

- E-commerce history

- Employment & income trends

- 91% of consumers prefer brands offering personalized recommendations (Accenture).

- Predictive AI boosts cross-sell & upsell by 20–30%.

- When customers may need loans, mortgages, or insurance

- Potential financial stress (e.g., cash flow shortages)

- Personalized investment opportunities

- Case in Point: Bank of America’s Erica (25M+ users) delivers proactive alerts, spending insights, and tailored savings recommendations.

- 60%+ of U.S. equity trades now powered by AI (Deloitte).

- AI-driven strategies can outperform traditional models by up to 35%.

- Parsing social sentiment (Reddit, Twitter)

- Real-time news/event analysis

- Predictive modeling of asset price movements

- Global banks spend $270B+ annually on compliance (Thomson Reuters).

- Non-compliance penalties exceeded $10.4B in 2022.

- Detecting AML (Anti-Money Laundering) risks

- Simulating stress-test scenarios

- Identifying potential issues early

- Anticipating questions before they’re asked

- Offering proactive financial alerts

- Routing to the right human agent at the right time

- AI could add $1.2T to global financial services by 2030 (PwC).

- Early adopters report:

- 30–40% cost reduction in operations

- 20% revenue uplift from AI-enabled models

- 52% improved engagement

- 45% reduced fraud-related losses

- With fintechs and Big Tech (Amazon, Google, Apple, Alibaba) doubling down on AI, traditional institutions risk:

- Losing customers to superior digital experiences

- Bearing higher costs from inefficiencies

- Facing fines due to weak compliance systems

- Suffering reputation loss from fraud or breaches

- Inaction is not neutral — it’s costly.

A Snapshot: What Predictive AI Can Achieve for Finance Sector

In a Nutshell:

From fraud prevention to personalized banking, from predictive trading to proactive compliance, AI is revolutionizing the financial sector at every level.

Firms that fall out of step risk irrelevance. Those that lead with predictive AI will set tomorrow’s industry standards.

At Ambit, we help financial institutions design secure, scalable, and compliant AI solutions — empowering foresight, smarter decisions, and sustainable growth. Talk to our experts.