nexaFIN for Financial Services

Today, Financial Services organizations need a modern, AI-driven CRM to manage customer relationships across a complex range of financial services. nexaFIN enables organizations to leverage intelligent automation, predictive insight, and engagement tools in all areas of banking, including retail lending, business & corporate lending, investment banking, wealth management, digital banking, insurance, and asset management. nexaFIN unlocks the power of AI-driven analytics and workflow automation to help finserve organizations manage customer interactions, operations, implements more cross selling and retention cost effectively, ultimately enabling revenue. nexaFIN is the only platform that brings it all together with automation and compliance for banks as the landscape of financial services changes and in an increasingly analytical first landscape.

Relationship Management

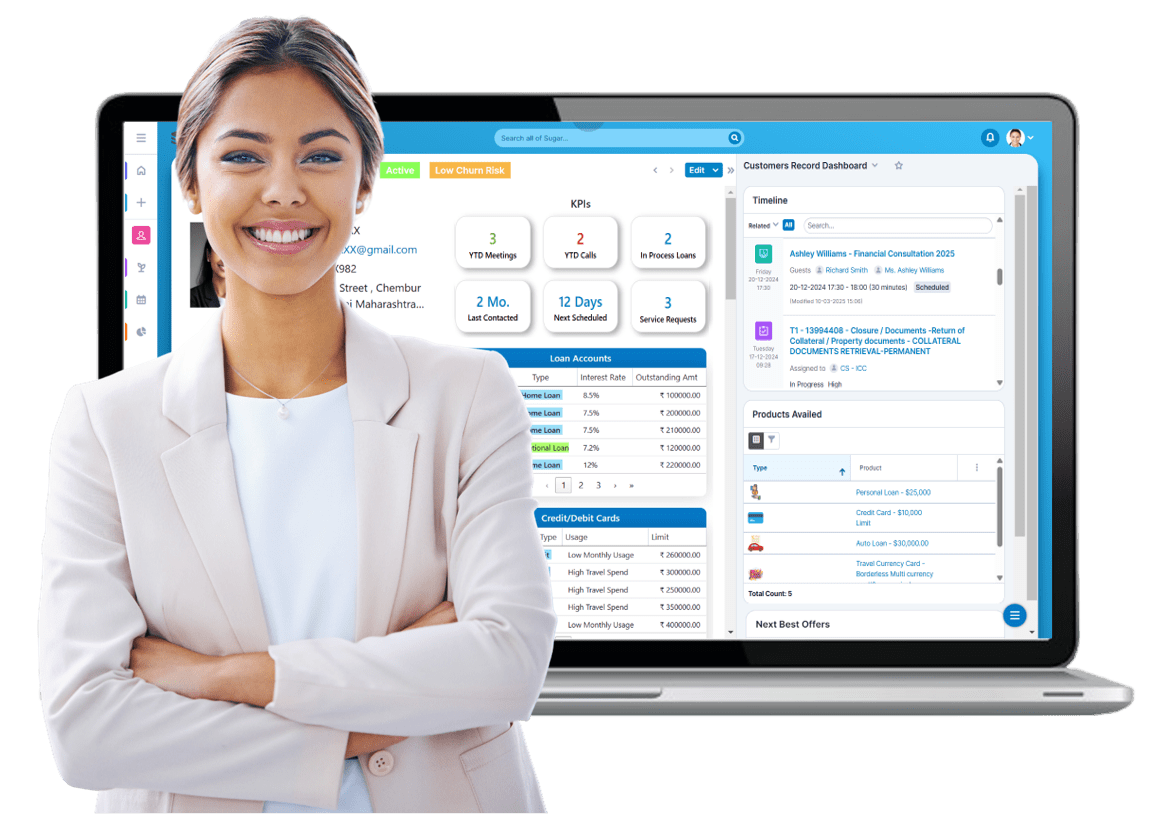

Knowing customers is crucial for successful relationship management. With nexaFIN, financial institutions get a 360-degree view of customers’ interactions, interests, and financial behavior. This end-to-end view helps to create hyper-personalized engagements that are meaningful, timely, and impactful. Through data-driven insights, businesses are able to foresee customers’ needs, improve satisfaction, and build long-term relationships.

Using AI-driven predictive analytics, nexaFIN identifies the right high-potential leads, and the likelihood of conversion on each lead. The predictive analytics consider the customer’s engagement history, transaction history, the time, and behavioral patterns so that relationship managers can prioritize high-potential opportunities. Additionally, predictive models suggest the next best action for engagement which could be continuing to cross-sell, up-sell or retention methodology. Now, businesses can begin to act smarter as every decision would be data driven. Furthermore, intelligent lead scoring and tracking of opportunities enables sales teams to maximize efficiencies and revenue growth!

Financial institutions often rely on external credit risk and offer engines like SAS to generate pre-approved offers for customers. nexaFIN seamlessly integrates with these external systems, ensuring that relationship managers have real-time access to relevant pre-approved financial products. This integration allows businesses to present targeted offers efficiently, improving customer engagement while maintaining compliance and accuracy.

nexaFIN is built for the modern, digital-first world. The platform is mobile-ready, ensuring that relationship managers and customers can engage anytime, anywhere. Additionally, advanced analytics and gamification features drive user engagement, helping businesses monitor key performance metrics while enhancing customer participation. By incorporating real-time dashboards, insights, and interactive elements, nexaFIN empowers financial teams to make data-driven decisions that elevate customer relationships.

Front Office & Client Services

nexaFIN streamlines loan origination with a complete digital loan origination process that reduces manual intervention. With dynamic forms, the system adjusts to borrower profiles and product types, providing accurate data capture and minimizing application errors. This enhances speed, compliance, and borrower experience in retail, SME, or corporate lending

nexaFIN empowers relationship managers to provide personalized financial advisory services. By integrating with analytical systems, the platform recommends next-best products and services, ensuring that customers receive tailored financial solutions at the right time. This intelligence helps organizations increase product adoption, improve engagement, and drive revenue growth.

Clients require a unified experience through all channels, either online, mobile, or in-branch. nexaFIN provides an omni-channel-capable front-office system that facilitates fluid interaction across touchpoints. Moreover, nexaVOX AI-driven workflows automate repetitive operations, cutting processing time and enhancing operational efficiency.

Real-time insights are crucial for improving customer service performance and decision-making. nexaFIN provides dynamic dashboards and AI-driven reports, enabling finserve organizations to monitor key performance metrics, track service requests, and optimize front-office operations. These insights allow organizations to proactively address customer needs, enhance efficiency, and deliver superior experiences.

Lending & Loan Servicing

nexaFIN provides a completely digital loan origination platform that provides an end-to-end process for all loans to be processed with a minimum of friction. Utilizing dynamic forms, nexaFIN effectively captures all relevant and required information and adapts the flows of applications based on customer or applicant input. This will deliver a quicker, more accurate and ultimately, more efficient loan approval process and thereby provide improved experience for clients and enhanced operational efficiency for the lender.

A robust underwriting process is critical to mitigating risk. nexaFIN brings credit risk evaluation tools into the fold, enabling organizations to automate eligibility verification, evaluate borrower profiles, and integrate third-party credit score systems. By simplifying risk analysis and approval processes, nexaFIN enables organizations to make quicker, fact-based lending decisions while reducing risk exposure.

Efficient loan servicing is important to keep portfolios in good health. nexaFIN supports integration with multiple Loan Management Systems (LMS) and provides alerts on loan servicing that inform organizations about payment due dates, delinquency threats, and restructuring possibilities. Moreover, portfolio performance monitoring delivers real-time information to organizations on loan repayment patterns, default threats, and profitability indicators, enabling them to make the most out of lending strategies.

To enhance service efficiency, nexaFIN automates loan servicing notifications, customer escalations, and SLA tracking. The system ensures that borrowers receive timely reminders for payments, interest rate changes, or renewal options, reducing missed payments and improving customer engagement. Automated escalation mechanisms ensure that high-risk cases are flagged to the appropriate teams, allowing organizations to take proactive measures before risks escalate.

Customer Experience & Engagement

nexaFIN supports you with a case management system that allows you to centralise tracking, assigning, and resolution of customer inquiries. It enables tracking of any type of inquiry, service requests, transaction disputes or loan application calls and will help you resolve inquiries quicker with automated workflows and SLA driven tracking. Finserve organisations can define service commitments with response timings, automate escalations whenever necessary to comply with service-level agreements (SLAs) to ensure efficiency and improve customer satisfaction.

Customer disputes and crisis management involve speedy action and clearly defined escalation procedures. nexaFIN allows organizations to effectively process disputes and crisis management with auto-workflows. The platform can identify high-risk cases, activate real-time notifications, and send them to the right resolution teams. Through transparent and speedier dispute resolution, organizations are able to establish customer trust without compromising regulatory standards.

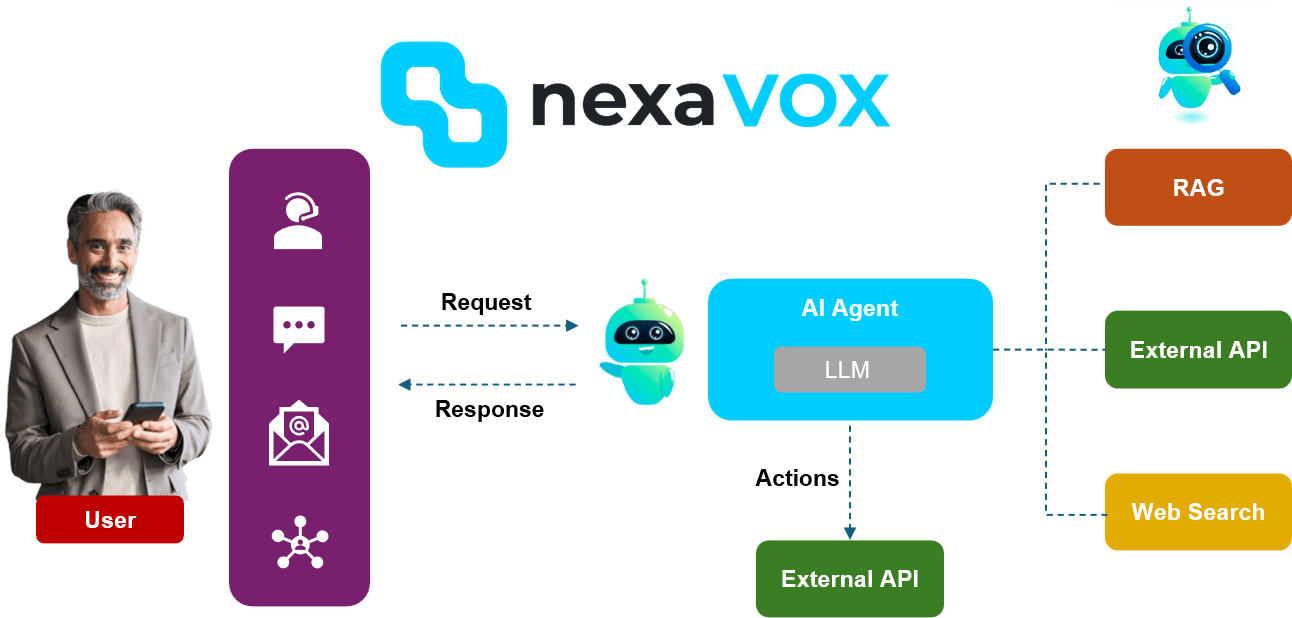

Customers want seamless experiences across digital, mobile, and in-branch channels. nexaFIN provides an integrated omni-channel experience where every interaction—via email, chat, phone, or web—is captured and dealt with seamlessly in real-time. Moreover, nexaVOX Agentic AI-based workflows automate regular customer inquiries, offer smart responses, and present next-best actions for service teams. This enhances operational effectiveness and enriches the customer experience.

nexaFIN provides sophisticated reporting and analytics, enabling organizations to track important customer experience metrics like case resolution times, customer sentiment, and engagement trends. Interactive dashboards provide real-time visibility to service teams about customer issues, facilitating ongoing service delivery improvement. These insights enable organizations to make better decisions, optimize workforce performance, and deliver a better customer experience.

Marketing

nexaFIN enables finserve businesses to run multi-channel campaigns by combining nexaVOX AI Agents with marketing automation platforms that enable email, SMS, social media, and print campaigns. With lead nurturing workflows, businesses can interact with prospects at each stage, providing a seamless experience from awareness to conversion. These integrations provide hyper-personalized engagement, ensuring the right message reaches the right people at the right time.

With nexaFIN’s integration with tools like Adobe, HubSpot, Sugar Market, and Netcore, organizations can automate drip campaigns to consistently engage customers over time. Whether it’s educating customers about financial products or reminding them about upcoming renewals, these campaigns help maintain strong engagement. Additionally, landing page optimization features from these platforms ensure that marketing efforts drive high conversion rates.

nexaFIN marketing integrations provide organizations with the ability to track and measure campaign performance through powered analytics and AI-driven insights. With integration into tools such as Salesforce Marketing Cloud, Sprout Social, and Netcore, organizations can access in-depth customer behavior, campaign performance, and conversion rate visibility. These allow marketing teams to optimize strategies and drive maximum return on investment (ROI).

nexaFIN’s seamless integration with leading tools allows organizations to optimize SEO and SEM campaigns, ensuring better visibility for their financial products. Additionally, with platforms like Sprout Social, organizations can manage social media campaigns, monitor engagement, and track brand sentiment in real-time. This helps organizations stay ahead in digital marketing while building trust and loyalty with customers.

Compliance Management

nexaFIN allows organizations to track and monitor compliance with regulatory requirements of the industry, such as Know Your Customer (KYC), Anti-Money Laundering (AML), and other financial governance rules. By bringing compliance information into a single system, organizations can effectively manage risk assessments, track suspicious transactions, and automate regulatory reporting to guarantee complete compliance with legal obligations.

Through real-time monitoring of compliance, nexaFIN offers immediate alerts and notifications for possible risks, frauds, or regulatory policy breaches. Automated alerts make sure that compliance officers and risk management teams receive immediate notification so that they can take proactive action before problems get out of hand. This enables organizations to reduce compliance risks and avoid regulatory fines.

To ensure accuracy and accountability, nexaFIN incorporates a Maker-Checker framework, requiring approvals at multiple levels for master data changes. Comprehensive audit trails capture every action taken within the system, ensuring a transparent and tamper-proof record for internal audits and external regulatory inspections. This feature enhances operational integrity while ensuring compliance with governance standards.

nexaFIN’s process and rule engine allows organizations to set up compliance workflows based on selected regulations and internal policies. The solution offers in-depth analytics and reporting that provides compliance teams with real-time insights into regulatory performance, exposure to risk, and compliance metrics. These insights enable organizations to refine compliance strategies, minimize operational bottlenecks, and stay fully aligned with changing industry standards.

Agentic AI Features

nexaFIN’s Agentic AI empowers financial service professionals with real-time insights and intelligent nudges at the point of interaction. Whether it’s understanding a customer’s historical data, predicting lead conversion probability, or summarizing customer records instantly, sales teams benefit from AI copilots that streamline and accelerate their decision-making process. This leads to improved response time, higher engagement, and ultimately, increased closure rates.

Using deep data signals and behavior analytics, nexaFIN’s Agent Assist dynamically presents the most relevant and timely product offers—tailored to each customer’s credit profile, needs, and journey stage. From personal loans to credit cards, this feature enhances up-selling and cross-selling effectiveness by ensuring that every interaction is contextual, timely, and valuable to the customer.

nexaFIN’s Service Copilot feature blends sentiment analysis with intelligent case management. It understands the tone and urgency of customer communications, summarizes case histories, and surfaces critical details to service agents in seconds. This ensures a more empathetic, accurate, and efficient customer service experience—boosting both agent productivity and customer satisfaction.

At the core of nexaFIN’s Agentic AI is a powerful architecture that integrates natural language inputs, reasoning engines, external APIs, and retrieval-augmented generation (RAG). This enables the system to autonomously generate, execute, and refine workflows based on evolving data. Reinforcement learning ensures that recommendations and automations continuously improve, resulting in adaptive, intelligent service delivery that scales with your organization.

Flexible Deployment Models

Financial Services organizations require a CRM solution that is flexible enough to fit their security, compliance, and operational needs. nexaFIN, based on SugarCRM, provides flexible deployment models, such as on-demand (cloud-based), private cloud, and on-premise installations. Whether organizations want a scalable SaaS model, a private cloud for more control, or an on-premise installation for regulatory compliance, nexaFIN offers the flexibility to accommodate different IT environments. With secure, scalable, and customizable deployment choices, nexaFIN helps organizations automate processes, enhance customer engagement, and have complete control over data and compliance needs.

Integration Landscape

Today’s finserve companies are based on an integrated ecosystem of financial systems and digital platforms.

nexaFIN, designed on SugarCRM, integrates flawlessly with core banking systems, loan management systems, underwriting systems, KYC/AML compliance, credit card management, BI & analytics tools, and more. By integrating with account opening systems, document management, claims processing, and mobile banking solutions, nexaFIN provides a single view of customer information, streamlined processes, and automated compliance monitoring. This broad integration ability enables organizations to achieve improved operational efficiency, better risk management, and superior customer experiences while remaining fully regulatorily compliant.