nexaFIN for Insurance

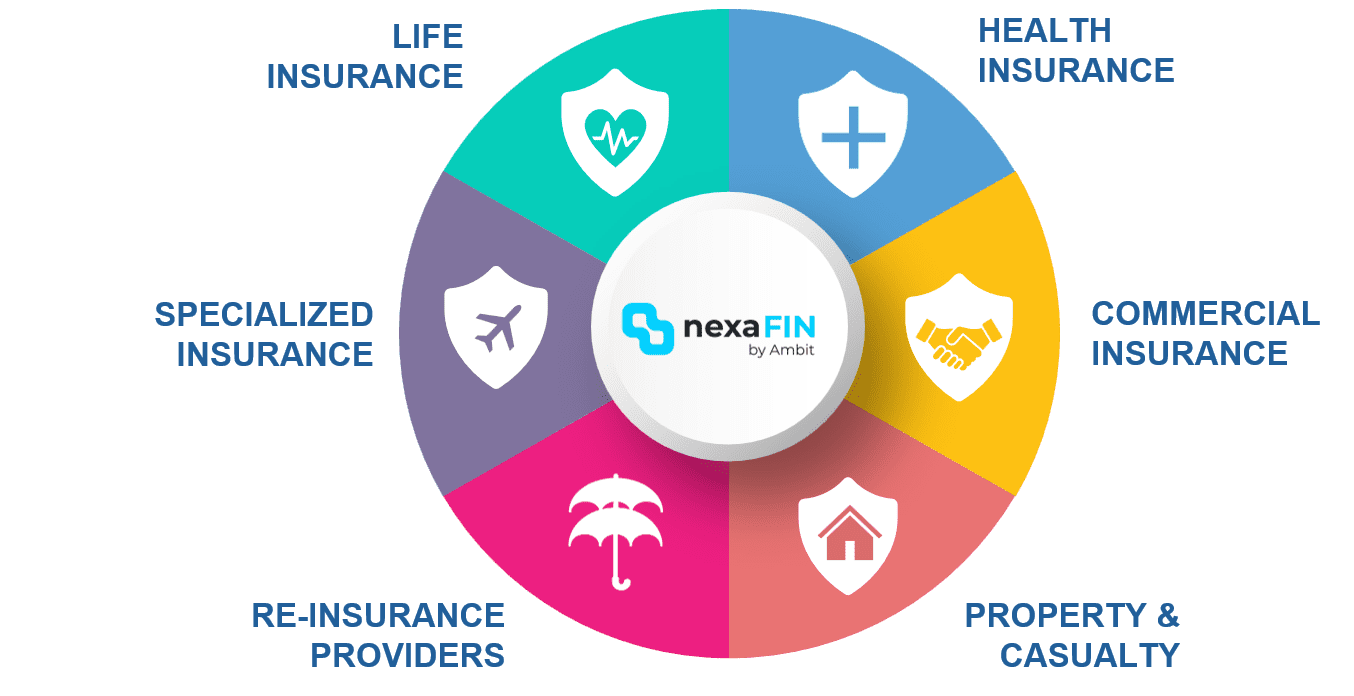

Today’s insurers need a modern, AI-driven CRM that can help navigate changing customer expectations, regulatory demands and competitive pressures. With its purpose-built functionality, nexaFIN for Insurance can help insurance companies leverage intelligent automation, real-time insights, and seamless engagement across life, health, property & casualty and commercial lines of insurance. With embedded AI-powered analytics and automated workflow orchestration within nexaFIN, insurers can tailor policyholder experiences, speed up claim processing, Improve underwriting efficiency and agent productivity. In addition to an integrated platform for cross-selling and better customer retention, nexaFIN also simplifies regulatory compliance, positioning insurers to thrive in a rapidly changing insurance landscape.

Relationship Management

nexaFIN consolidates data from multiple touchpoints to deliver a 360-degree view of each policyholder—covering policy history, interactions, claims, preferences, and more. With this unified view, insurers can engage customers with hyper-personalized communications, offers, and services tailored to their unique profiles. This results in deeper trust, better retention, and stronger customer loyalty.

From prospect to policyholder, nexaFIN assists insurance teams with the entire lead-to-policy process. Smart lead scoring and tracking functionality ensures that high-potential leads are ranked first, and opportunity management capabilities assist with streamlining the sales pipeline. Integration with external systems is also supported to provide pre-approved insurance quotes, which allows for faster conversion and better responsiveness.

nexaFIN allows insurers to control the complete policyholder journey, from onboarding and renewals to cross-sell and upsell. With AI-driven predictions, insurance teams can automatically detect churn risks, predict customer needs, and suggest the next-best product or service. This drives policy take-up, satisfaction, and attrition reduction.

In the mobile-first age, nexaFIN is mobile-enabled, allowing sales and service teams to remotely access real-time customer information. Gamification and performance analytics further encourage relationship managers and monitor progress through dynamic dashboards and KPIs. This maximizes both policyholder interaction and internal team performance.

Front Office & Client Services

nexaFIN enables onboarding customers quickly and with nearly no friction through our digital workflows and smart forms – minimizing paperwork and speeding the issuance of policy. The nexaFIN platform provides a true omni-channel experience, giving policyholders access to mobile, web, in-person, and contact center channels – all while ensuring that each information exchange is consistent and coordinated across each service team.

Insurers can only support distribution efficiently through agents and brokers if they provide the appropriate level of support. nexaFIN users improve agent performance through a centralized system for tracking performance, assigning leads, and managing commission workflows, while service agents can offer policy recommendations automatically generated based on the clients’ profiles. This in turn helps improve partner enablement and customer relevance in every client interaction.

nexaFIN leverages historical data and behaviors to offer next-best insurance offers for front-lines teams to drive cross-sell and up-sell opportunities efficiently. Additionally, AI-powered workflow automation enables the completion of the routine tasks that most front-line teams undertake (endorsements, renewals, quote follow-ups etc.) seamlessly and expediently, allowing more time for value-added engagement and speedier response.

nexaFIN empowers front office personnel with interactive forms that adjust dynamically according to policy type, customer information, or service situation—reducing errors and time taken in processing. At the same time, real-time reports and dashboards offer insight into service performance, outstanding actions, and customer patterns, allowing teams to make informed decisions that drive a better overall service experience.

Policy Administration

nexaFIN allows insurers to integrate with their policy systems and underwriting systems that can support automated workflows to create policies and approvals and create policy documents. By bringing together policy and risk data into a single workflow, underwriting and operations staff can streamline the issuance process, reduce turnaround time for issuance, and eliminate unwanted actions through manual handoffs to compliant, consistent, automated issuance activity.

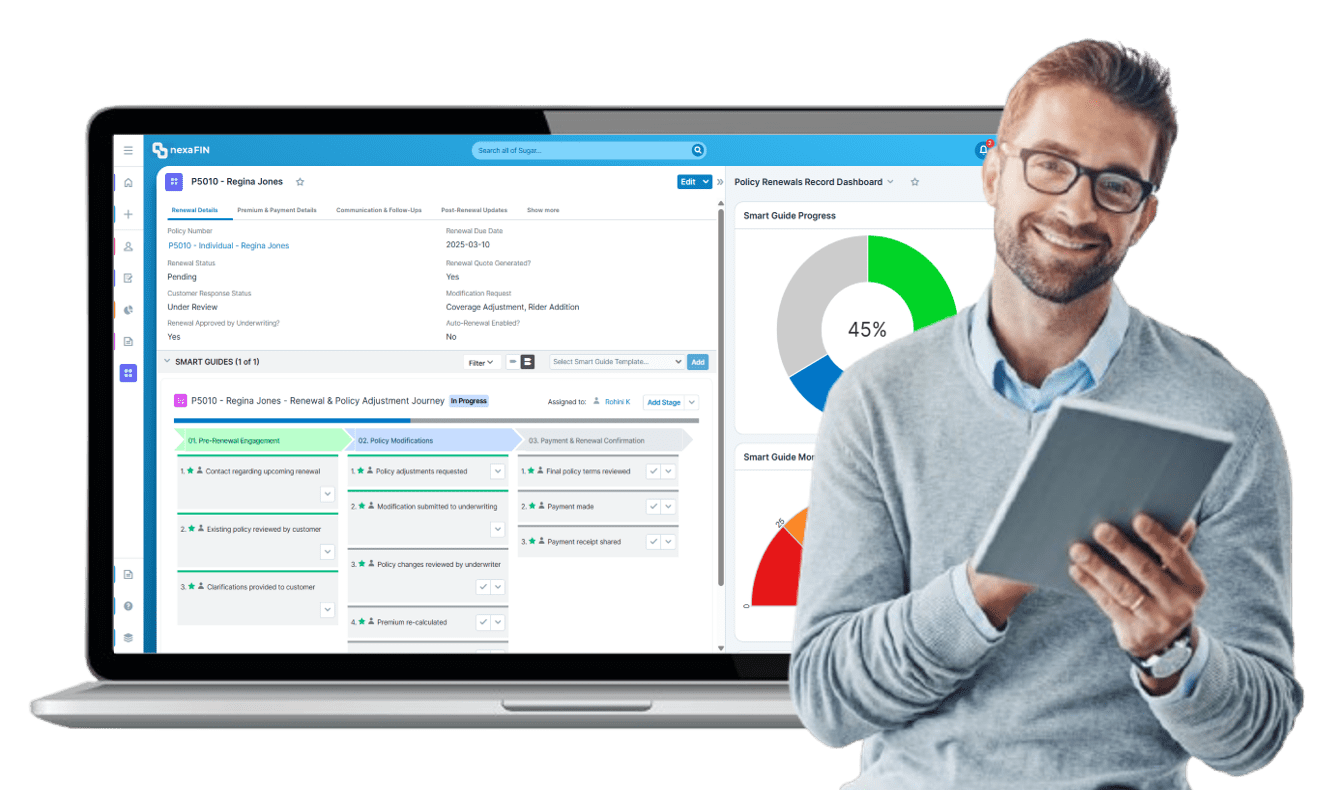

nexaFIN now turns your renewals from a reactive activity into a proactive and efficient process through automated reminders of expiry and renewal quotes, as well as agent follow ups on renewal actions. Furthermore, nexaFIN allows for tracking and following up on collections for overdue premiums, as well as escalating and providing status updates to the appropriate teams. In this manner, insurers can retain revenue without service disruptions or paperwork delays, as well as minimize lapses in coverage.

Responding to service requests and policy requests in a timely manner, is a critical activity. nexaFIN automatically tracks SLAs, so that policy servicing activities such as endorsements, cancellations or changes can be resolved within stipulated timelines. Automatic notifications and escaltation workflows will align service teams to improve customer satisfaction and compliance.

With intelligent, adaptive forms, nexaFIN enables insurers to collect and validate information effectively across a range of policy processes. From issuing a new policy to processing a mid-term adjustment, the platform adjusts to the policy type and transaction type, reducing errors and increasing operational flexibility.

Customer Experience & Engagement

nexaFIN has centralized claims and case management to help service teams track, prioritize, and settle customer requests efficiently. Whether a policy query, a follow-up on a claim, or a complaint on services, every case is processed using predefined workflows with SLA-based notifications and escalation, ensuring prompt resolution and team accountability.

nexaFIN has centralized claims and case management to help service teams track, prioritize, and settle customer requests efficiently. Whether a policy query, a follow-up on a claim, or a complaint on services, every case is processed using predefined workflows with SLA-based notifications and escalation, ensuring prompt resolution and team accountability.

nexaFIN equips customer service teams with automated processes that eliminate repetitive work like endorsements, policy changes, and claim status updates. Coupled with smart forms that automatically adjust to policy types and customer context, insurers can minimize mistakes, accelerate servicing, and provide consistent experiences throughout all customer paths.

With real-time dashboards and built-in reports, nexaFIN provides insurers with visibility into case loads, service quality measures, and customer trends. Automated alerts keep agents and policyholders up to date, lowering follow-up questions and enhancing satisfaction. These analytics enable insurers to continually refine processes and provide proactive, high-quality service.

Marketing

nexaFIN allows insurers to run multi-channel campaigns that include an array of nexaVOX AI Agents as part of integrated marketing automation tool with capabilities in email, SMS, social media, and physical campaigns. Insurers can create lead nurturing workflows to connect with prospects at every step of the funnel to facilitate movement from awareness to conversion. These campaigns can be executed and polled in a highly personalized way at the right time to the right audience.

Drip campaigns can be automated through nexaFIN’s integrations with HubSpot, Sugar Market, and Netcore lead nurturing platform to ensure consistent customer touch points over periods of time. If educating customers about financial products or gently reminding them of ongoing renewals, these campaigns create opportunities to stay engaged over time. The landing page optimization capabilities from these platforms further guarantee that marketing investment is converted into effective conversion rates.

The marketing integrations in nexaFIN empowers insurers to measure and track campaign effectiveness using analytics insights powered by AI technology. They are aggregated to provide detailed understanding of customer movement, campaign performance, and conversion rates using nexaFIN’s integrations with Salesforce Marketing Cloud, Sprout Social, and Netcore. By providing constant insight to marketing teams, they can continually create comprehensive marketing strategies and achieve better return on investment.

The flexibility of nexaFIN’s integration with leading tools allows insurers to optimize SEO and SEM campaigns for the increased visibility of their financial products. In addition to supporting SEO and SEM optimization, nexaFIN can help insurers launch a social media campaign. With the ability to manage social media accounts and monitor engagement and brand sentiment across multiple sites, insurers can take charge of their social media accounts while also fanning the flames of brand trust and loyalty with customers.

Compliance Management

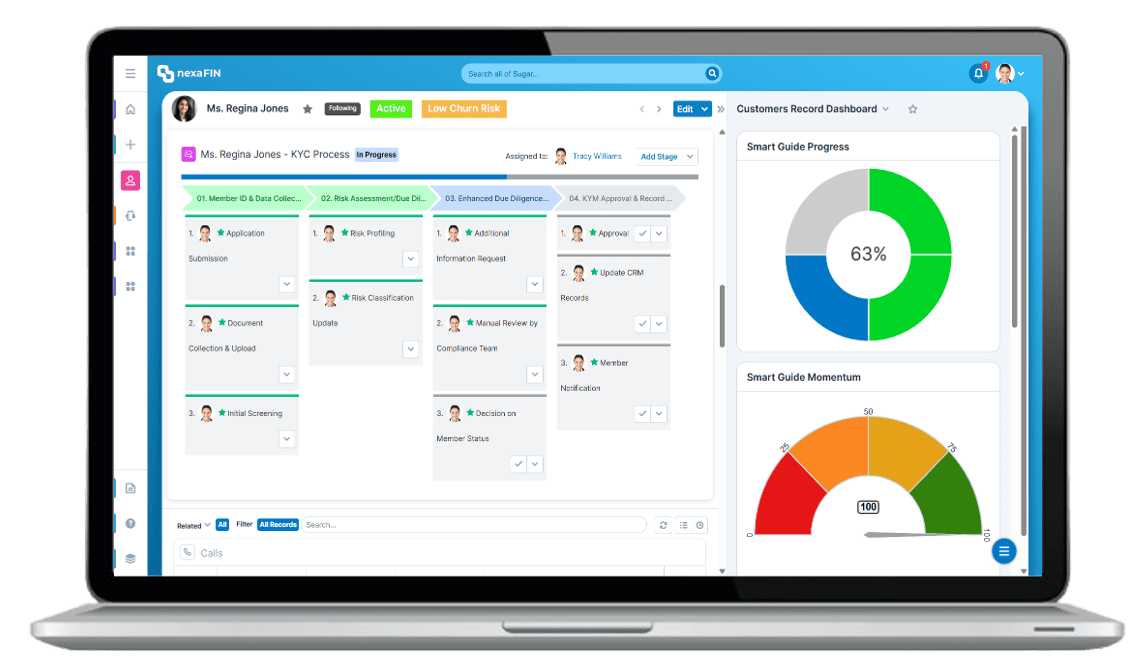

nexaFIN allows insurers to more easily track compliance with regulations in the insurance and financial services industry (Know Your Customer (KYC), Anti-Money Laundering (AML), and other operational or financial governance frameworks). Compliance data is then aggregated in a repository for managing risk management assessments, for monitoring suspicious activity, and creating reports to prove compliance with legal regulations.

nexaFIN allows insurers to more easily track compliance with regulations in the insurance and financial services industry (Know Your Customer (KYC), Anti-Money Laundering (AML), and other operational or financial governance frameworks). Compliance data is then aggregated in a repository for managing risk management assessments, for monitoring suspicious activity, and creating reports to prove compliance with legal regulations.

In a Maker-Checker model, nexaFIN holds users accountable through multiple approvals for the master data being altered (e.g., reporting misrepresentation). An audit trail is generated by every action that users perform in the system, allowing for internal or external audits for regulatory authorities to monitor abnormal behavior in nexaFIN as a source for governance-based risk-based audits. Therefore, compliance efforts are focused not only on outcomes, but a demonstrated integrity in operation.

In a Maker-Checker model, nexaFIN holds users accountable through multiple approvals for the master data being altered (e.g., reporting misrepresentation). An audit trail is generated by every action that users perform in the system, allowing for internal or external audits for regulatory authorities to monitor abnormal behavior in nexaFIN as a source for governance-based risk-based audits. Therefore, compliance efforts are focused not only on outcomes, but a demonstrated integrity in operation.

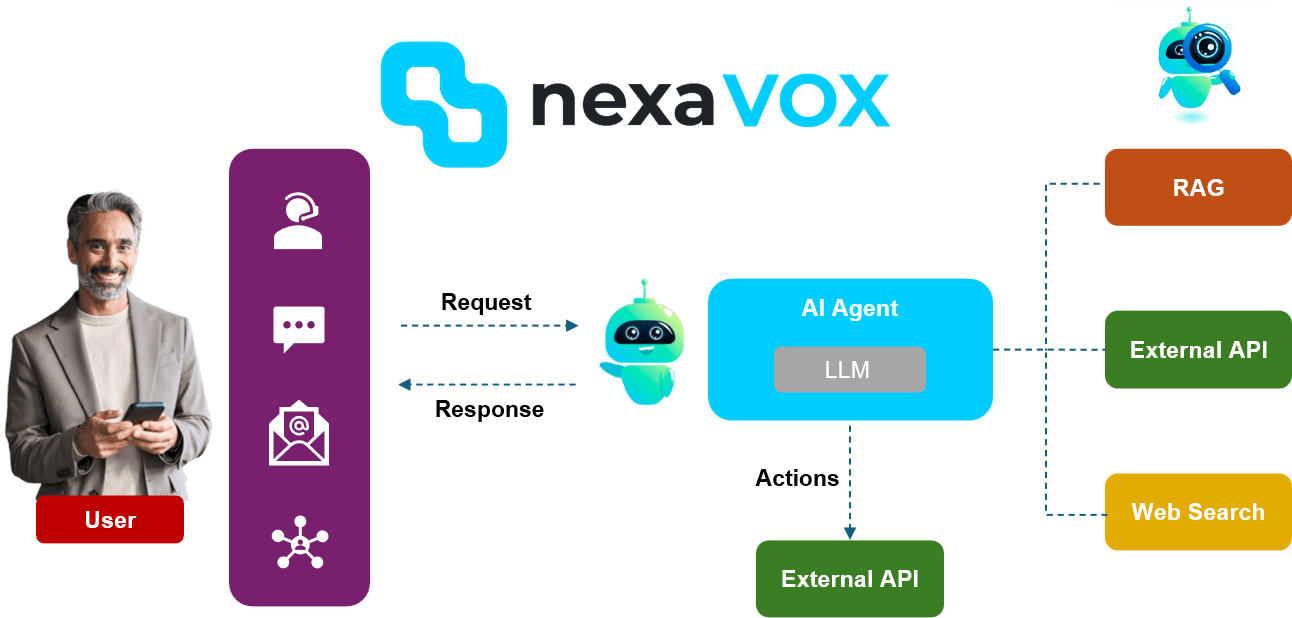

Agentic AI Features

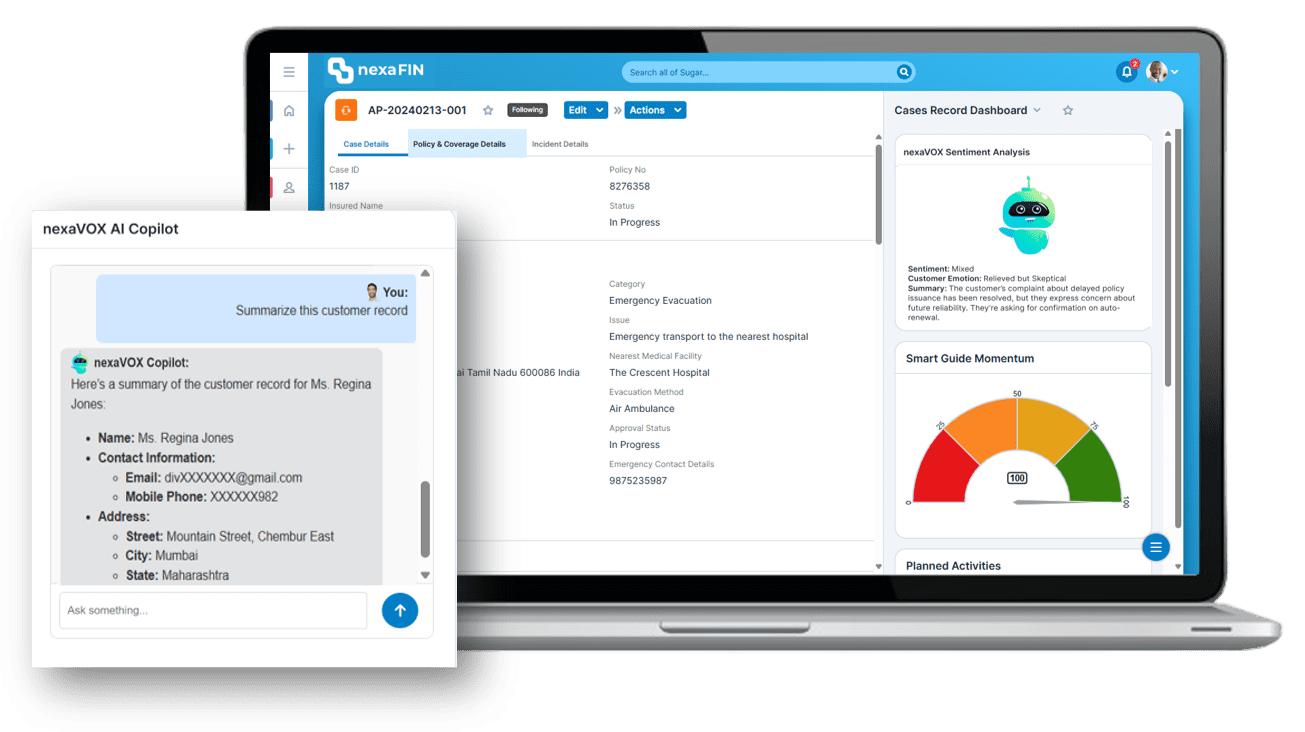

nexaVOX equips agents with AI-driven decision support during customer interactions. With features like conversion prediction scoring and real-time customer data summarization, agents can prioritize high-potential leads and tailor conversations on the fly. The AI Copilot summarizes key customer insights such as contact history, preferences, and location—all within a single interface—enabling more meaningful and effective engagement.

Delivering the right product at the right time is made possible with nexaVOX Agent Assist. It suggests Next Best Offers (NBOs) by analyzing individual customer health, lifestyle data, and policy history. For example, it can recommend mid-tier plans with critical illness riders or wellness rewards for preventive care. This intelligent personalization drives both higher conversion and long-term loyalty.

Customer service teams are empowered with nexaVOX’s Service Copilot, which performs sentiment analysis and emotional interpretation on customer feedback. It synthesizes emotional cues and summary insights from case histories to guide agents in handling sensitive conversations and timely escalations. Whether it’s about delayed claims or policy renewals, service teams get clear, actionable context—automatically.

The Agentic AI FLOW engine in nexaVOX transforms simple natural language inputs into automated insurance workflows. From interpreting customer intent to generating and executing workflows (such as claims, endorsements, or policy updates), it ensures intelligent, autonomous action. Reinforcement learning continuously improves the system, optimizing outcomes and reducing operational effort across the lifecycle.

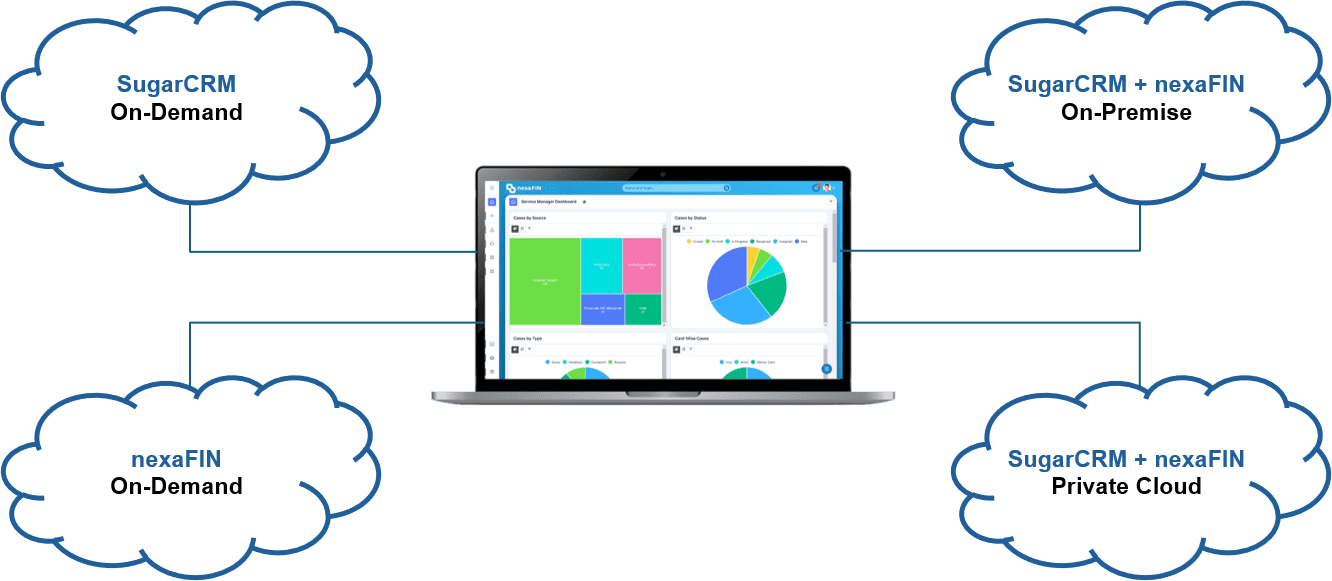

Flexible Deployment Models

Insurers need a CRM which can adapt to the insurer’s security, compliance, and operational needs. nexaFIN is built on SugarCRM and has deployment flexibility across a multitude of installation options including on-demand (cloud-based), private cloud, and on-premise designs. Depending on whether insurer’s prefer a scalable version that uses SaaS model, a private cloud that better enables control, or an installation that is on-premise because of regulatory issues, nexaFIN can provide the flexibility to meet the wide range of IT environments. Flexible, secured, scalable and customized for deployment, nexaFIN provides insurers robust solutions to reduce operational defects, increase customer engagement, and retain complete control over their data and regulatory compliance needs.

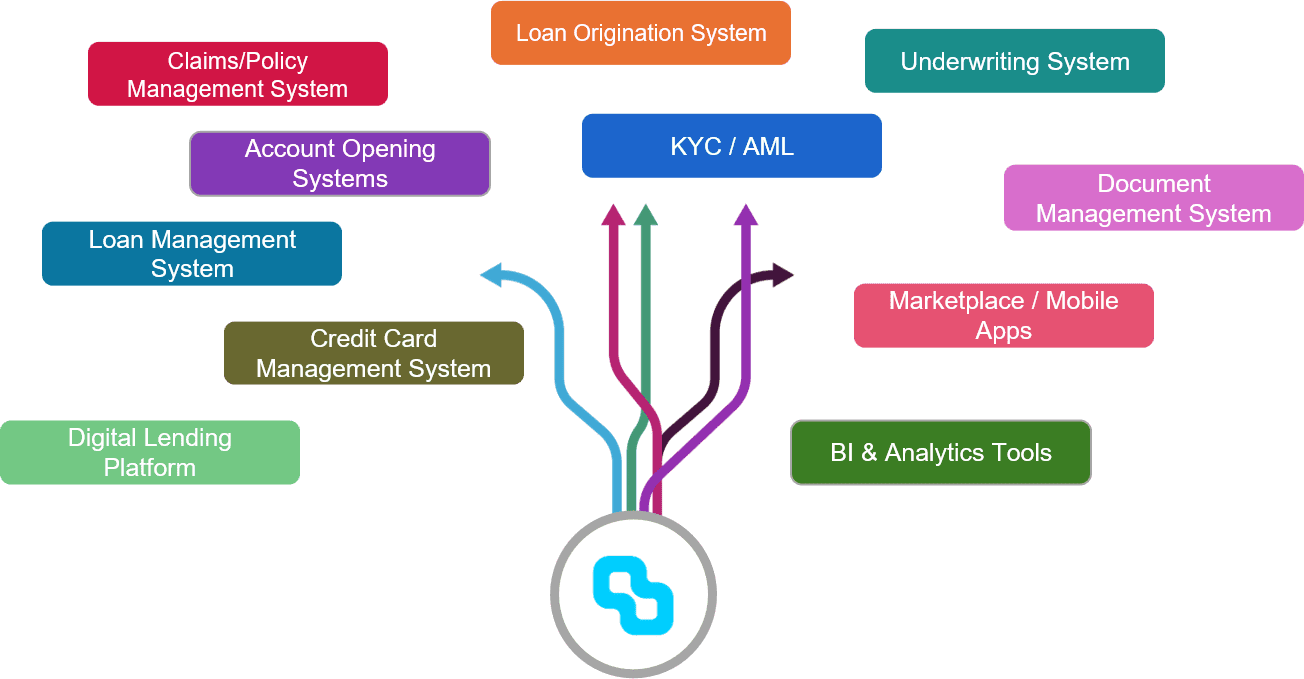

Integration Landscape

Insurers need a CRM which can adapt to the insurer’s security, compliance, and operational needs. nexaFIN is built on SugarCRM and has deployment flexibility across a multitude of installation options including on-demand (cloud-based), private cloud, and on-premise designs. Depending on whether insurer’s prefer a scalable version that uses SaaS model, a private cloud that better enables control, or an installation that is on-premise because of regulatory issues, nexaFIN can provide the flexibility to meet the wide range of IT environments. Flexible, secured, scalable and customized for deployment, nexaFIN provides insurers robust solutions to reduce operational defects, increase customer engagement, and retain complete control over their data and regulatory compliance needs.